By Andy May

By Andy May

“Prediction is very difficult, especially about the future” (old Danish proverb, sometimes attributed to Niels Bohr)

In November, 2016 the USGS (United States Geological Survey) reported their assessment of the recent discovery of 20 billion barrels of oil equivalent (technically recoverable) in the Midland Basin of West Texas. About the same time IHS researcher Peter Blomquist published an estimate of 35 billion barrels. Compare these estimates with Ghawar Field in Saudi Arabia, the largest conventional oil field in the world, which contained 80 billion barrels when discovered. There is an old saying in the oil and gas exploration business “big discoveries get bigger and small discoveries get smaller.” As a retired petrophysicist who has been involved with many discoveries of all sizes, I can say this is what I’ve always seen, although I have no statistics to back the statement up. Twenty or thirty years from now when the field is mostly developed, it is very likely the estimated ultimate hydrocarbon recovery from the field will be larger than either of those estimates.

Producing oil and gas from shale was unknown in the 1950’s when the irascible geologist Marion King Hubbert predicted that U.S. oil production would peak in the early 1970’s and decline thereafter. How is that prediction working out? Does the new shale production technology make a difference?

Definition of critical terms

Government regulations impose strict rules on how oil and gas reserves are estimated. Because, proven reserves are used to compute the equity of an oil and gas company, the calculation is very conservative. As long as a company follows the rules (and they do or they risk going to jail) accessing any “booked” proven reserves means drilling a well that is “economic,” completing it and producing the reserves. By economic, we mean the cost of drilling, completing, transporting and selling the oil or gas will pay the company back for its costs and provide a reasonable profit after taxes and royalties to the land owner are paid. Besides proven reserves, most companies keep track of probable reserves and possible reserves, these do not affect the equity of the company, but they can affect how investors value a company, and thus the stock price. Finally, there is one other category, called “technically recoverable reserves.” This is the broadest category, it is simply an estimate of how much oil and gas can be produced using current technology, regardless of cost or profitability.

Estimates of technically recoverable reserves are very broad brush. To make the estimate a geoscientist will typically map an oil or gas bearing formation and use the best estimate of the formations average oil and/or gas content to compute the OIP or oil-in-place after converting the gas to oil-equivalent. Once this volume is computed, it will be reduced by an estimated “recovery factor” to account for the oil left in the ground after the field is abandoned. Generally, very conservative values are used for both the volume of hydrocarbons and the recovery factor.

The US Department of the Interior Bureau of Ocean Energy Management published an estimate of the oil and gas reserves for the Gulf of Mexico Outer Continental Shelf in 2015, here. They estimated that total original reserves of this region of the Gulf of Mexico were 22 billion barrels of oil and 193 trillion cubic feet of gas. How did they define reserves? See figure 1:

Figure 1, source BOEM.

Here, reserves are defined as developed (a well has been drilled and completed that is expected to produce them), proven and undeveloped (field infrastructure has been built, but the well needed to produce the hydrocarbons has not been drilled yet) and justified reserves (these are discovered and mapped and both the government and the company have approved the field for development). The estimate above also includes oil and gas already produced. Contingent resources are mostly producible, but uneconomic, oil and gas left behind in abandoned fields. The undiscovered resources are estimated using statistical techniques, the methodology can be seen here. U.S. onshore reserves are defined differently as are reserves in other countries, but proven, probable and possible “reserves” usually have a commerciality component. Technically recoverable reserves do not have a commerciality hurdle, they only meet a technology hurdle.

Right after a field is discovered a calculation of economically producible reserves must be made because fields are very expensive to develop. Pipelines must be built, wells drilled, facilities constructed and all of this must be done with borrowed money. No oil is produced or sold and no money made until this work is done. As a result, this early assessment will be very conservative. In one field I was involved in, Bohai Bay Block 0436 in China, our initial estimate of proven reserves was only 80 million barrels of oil in the first 20 years. After twenty years, the field had produced 150 million barrels and the field is still producing today. We knew the upside potential of the field at the beginning, but we were only confident enough, with the data we had at the time, in the 80 million barrels. Thus, we used that as the “official” estimate and as the basis for borrowing the development money.

The impact of technology

In the early days of oil and gas, drillers selected the location of their exploration wells based on the presence of oil and gas seeps on the surface, for example the La Brea tar pits in Los Angeles, or the Binagadi tar lake near Baku, Azerbaijan. Figure 2 is a picture of the La Brea tar pits in 1875, you can see the old wooden drilling rigs in the background.

Figure 2, source La Brea Tar Pits Museum.

Once all the seeps had been drilled, early geologists like the legendary Everett Carpenter, found that they could locate anticlinal oil and gas accumulations by mapping surface geology in prospective areas. This new technology was used to find many very large oil fields, like El Dorado in Kansas. Later the development of commercial resistivity surveys (Schlumberger, 1912) and seismic surveys revolutionized oil and gas exploration. Reflection seismic was first tried by Dr. J. C. Archer in 1921 in Oklahoma. It was used to discover oil near Seminole, Oklahoma in 1928 as you can see in figure 3.

Figure 3, source here.

Each of these technologies allow oil and gas to be found and produced that could not have been found before. Other significant discoveries include the Hughes tri-cone drilling bit, patented by Howard Hughes Sr. in 1909. (figure 4).

Figure 4, source Texas Monthly.

That bit allowed wells to be drilled deeper and faster, greatly accelerating field development. These early discoveries were followed by the invention of water flooding old fields, the invention of modern well logging tools in the 1950’s and 1960’s to better assess the production potential of wells, the development of CO2 flooding (1970’s), 3D seismic surveys (1964), horizontal drilling (1980’s) and most recently widespread unconventional shale oil and gas wells (late 1990’s).

At every stage of technology development, it seems, someone says we are going to run out of oil and gas. Near the end of the “drilling surface oil seeps period” in 1885, when it was getting harder and harder to find more oil, the Pennsylvania state geologist proclaimed (according to Daniel Yergin’s The Quest):

“… ‘the amazing exhibition of oil’ was only a ‘temporary and vanishing phenomenon – one which young men will live to see come to its natural end.’ “

That same year John Archbold (Rockefeller’s partner in Standard Oil), when he heard oil had been discovered in Oklahoma, said:

“Why, I’ll drink every gallon of oil found west of the Mississippi.”

Of course, not long after this, modern petroleum geology and Hughes’ famous tri-cone bit revolutionized the oil and gas industry and unimaginable amounts of oil and gas were discovered as a result. And, yes, quite a lot of the oil and gas was found west of the Mississippi River. We have no record of Mr. Archbold drinking any of it, however.

By the end of WW I, the world had entered what Daniel Yergin calls the “Oil Age” and everyone knew it. According to Yergin, Lord Curzon, Great Britain’s foreign secretary once said:

“The Allied cause [in WW I] had floated to victory upon a wave of oil.”

Between 1914 and 1920 the numbers of registered automobiles grew fivefold and the director of the US Bureau of Mines said:

“… the oil fields of this country will reach their maximum production, and from that time on we will face an ever-increasing decline.”

This led President Wilson to say:

“There seemed to be no method by which we could assure ourselves of the necessary supply at home and abroad.”

The entire world came to depend upon oil for its automobiles, trains, ships and for light at night. The Japanese bombed Pearl Harbor for oil, Hitler invaded Russia for oil, the US had a secure supply of oil and prevailed in WW II largely for that reason. What would the world look like today if Hitler had invaded and conquered Azerbaijan and Kazakhstan rather than try and take St. Petersburg and Moscow? Perhaps very different.

At the start of WW II yet another “end of oil” panic started, it even affected the US Department of the Interior which announced:

“American oil supplies will last only another 13 years.”

Then in 1949, the department announced:

“… the end of U.S. oil supplies is in sight.”

After WW II, the US could no longer produce enough oil and did became a net importer for the first time. This led to worries about supplies and, in response, strong alliances with the major Gulf states of Saudi Arabia and Kuwait were formed to ensure a supply. President Truman was not only worried about losing access to Middle Eastern oil, he was also worried about the Soviets taking over Middle Eastern oil fields, especially in Iran. As a result, he ordered a new plan to be developed, according to the Brookings Institution:

“It is no coincidence that much of the early preoccupation with the potential Soviet threat after the end of World War II centered on the remaining Soviet presence in Iran. But unknown to the public until the recent declassification of National Security Council documents (first uncovered by a reporter for the Kansas City Star, Steve Everly) was the extent of Truman administration concern about the possible Soviet takeover of the oil fields. Equally surprising was that the Truman administration built its strategy not so much on defending the oil fields in the face of a possible Soviet invasion, as on denying the Soviet Union use of the oil fields if it should invade.

The administration quickly developed a detailed plan that was signed by President Truman in 1949 as NSC 26/2 and later supplemented by a series of additional NSC directives. The plan, developed in coordination with the British government and American and British oil companies without the knowledge of governments in the region, called for moving explosives to the Middle East, where they would be stored for use. In case of a Soviet invasion, and as a last resort, the oil installations and refineries would be blown up and oil fields plugged to make it impossible for the Soviet Union to use the oil resources.”

However, the 1950’s saw an explosion of new oil and gas technology, not oil fields. Oil and gas exploration expanded worldwide, particularly offshore, and supplies were abundant until the early 1970’s when Middle Eastern politics caused supplies to tighten, resulting in severe oil shortages. Again, the cries that “the end of oil is near” were heard. This time led by an irascible geologist named Marion King Hubbert. In the late 1950’s, using novel mathematics, he predicted that US oil production would peak in the early 1970’s. The rapid growth in oil and gas technology in the 1950’s was slowing at this time and large discoveries had been made so prices were falling. They stayed low during the 1960’s and by the time of the 1973 Arab-Israeli war, supplies and demand were nearly balanced. These two events allowed the Gulf states to engineer a boycott. Then prices spiraled just as many North American conventional oil fields were on a decline. At the time, it looked like Hubbert was correct.

The late 1960’s and the early 1970’s were filled with ominous predictions, in 1972 the Club of Rome predicted oil and natural gas would run out by 1992, in 1968 Paul Ehrlich predicted “65 million Americans will die of starvation between 1980 and 1989.” In 1978, Glenn Seaborg, chairman of the Atomic Energy Commission wrote:

“We are living in the twilight of the petroleum age.”

With higher oil prices, new oil and gas technology was developed at a frenetic pace. The 1970’s and 1980’s saw the development and implementation of 3-D seismic, deep water drilling, CO2 flooding of old oil fields, horizontal drilling, coal-bed methane production, formation image logs, NMR logging and many other critical technologies. The mid 1970’s and the early 1980’s were a wonderful time to be in the business. The new technology worked well, a lot of oil and gas was found, too much as a matter of fact; and the industry crashed in 1986 with the world awash in oil. It took many years to use up the surplus.

Research did not stop during this period, but it did slow down. In particular, UPR (Union Pacific Resources) perfected drilling and hydraulically fracturing (“fracking”) horizontal wells in a Texas formation called the Austin Chalk. At the same time a small oil and gas company, Mitchell Energy, was developing novel methods of hydraulically fracturing shale reservoirs, in particular, the Barnett Shale in Texas. Mitchell was drilling vertical wells and completing them; but having a hard time making the wells “economic” or profitable. George Mitchell, the owner of Mitchell Energy, was a victim of the low oil prices (as low as $10/barrel) of the late 1990’s and had to sell his company to Devon Energy in 2001. At Devon they combined the horizontal well technology that they had in house, with the novel shale completion techniques developed at Mitchell and were very successful. And, lucky for them, oil and gas prices started to rise, making the technology even more profitable.

The early days of shale completions were slow going, but by about 2005 drilling and completion technology, new petrophysical well evaluation technology, micro-seismic technology and new 3D seismic interpretation techniques had matured and the resulting oil and gas discoveries were huge. Unconventional oil and gas (shale production) is very different from conventional oil and gas. Where conventional reservoirs are small and hard to find, but very high permeability (meaning high oil and gas flow rates per foot of reservoir in the well), unconventional “resource” plays are enormous and cover huge areas, but very low permeability. We know where they are, the work is in figuring out how to drill and complete the wells in a profitable way. The author worked as a shale petrophysicist for Devon Energy and saw that it takes four or five wells (minimum) just to figure out if a shale play will work, sometimes more.

It took 17 dry holes and $10,000,000 for Harold Hamm and Continental Resources to figure out how to drill and complete a profitable well in the prolific Bakken Shale. He didn’t drill all of those wells to find the oil, he knew the oil was there, he drilled them to figure out how to successfully place the well in the formation and complete (“frack”) the well. Today, based on what he learned, we could do it with one well. It’s much more a science and engineering problem than an exploration problem. But, the technology worked and once again we are awash in oil and prices are low. It will continue to work and the technology will spread overseas, greatly increasing global production. As Daniel Yergin points out in The Quest:

“Hubbert got the date right, but his projection on supply was far off. Hubbert greatly underestimated the amount of oil that would be found – and – produced in the United States. By 2010 U.S. production was four times higher than Hubbert had estimated- 5.9 million barrels per day versus Hubbert’s 1971 estimate of no more than 1.5 million barrels per day.”

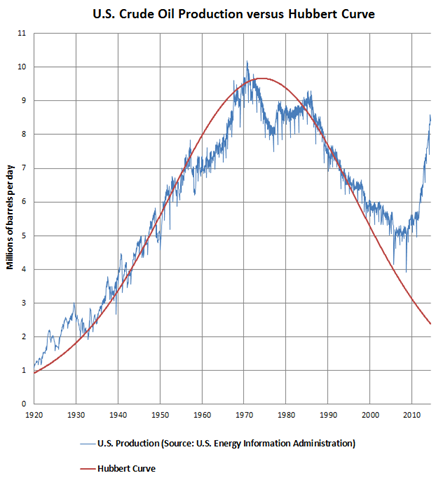

A comparison of actual oil production versus a version of Hubbert’s curve is shown in figure 5 (slightly different from the one Yergin used):

Figure 5, source

Technically Recoverable Reserves

So clearly Hubbert’s Malthusian curve did not predict oil supply correctly, new technology has allowed us to tap into oil that was not part of the potential supply when he did his calculation. Paul Ehrlich’s ominous 1968 prediction in The Population Bomb that 65 million Americans would starve to death in the 1980’s was incorrect for the same reason. He could not have predicted the green technology revolution that included natural gas based fertilizer (the Haber-Bosch process) and Nobel Prize winner Norman Borlaug’s new hybrid strains of wheat, rice and corn. Some might say, well Hubbert was wrong then; but what about tomorrow? Isn’t oil still a finite resource? Let’s examine that idea. Table 1 shows a rough estimate of the technically recoverable reserves of oil and gas known today, using only known oil and gas technology. More deposits will obviously be found and technology will improve in the future.

Table 1

The reserve estimates are in billions of barrels of oil equivalent. NGL and oil volumes are presented as is and natural gas is converted to oil-equivalent using the USGS conversion of 6 MCF to one barrel of oil. The table includes the “proven” worldwide oil, gas and NGL reserves from BP’s 2016 reserves summary. It also includes the 2012 USGS estimate of undiscovered “conventional” oil and gas reserves fully risked, the EIA estimate of unconventional shale oil and gas reserves, and the IEA oil shale (kerogen) and oil sands (bitumen) reserve estimates. Our estimate of 1,682 BBOE in world-wide unconventional shale oil and gas reserves is lower than the IEA estimate of 2,781. The spread in these estimates gives us an idea about how uncertain these numbers are. Our estimate of 781 BBO in oil sand bitumen reserves is lower than the IEA estimate of 1,000 to 1,500 BBO. So, please consider this table very conservative.

The USGS also has a report on oil shale “in-place” kerogen volumes here with different numbers. “Shale oil” is actual oil trapped in shale, for example the Bakken in North Dakota or the Eagle Ford in Texas. “Oil shale” is different, it is kerogen (not oil) trapped in a shale, an example is the Green River Formation in Colorado. Oil shale has been mined in several places around the world since the 1830’s. Shell has completed a pilot production operation, in the Green River oil shale in the Piceance Basin, in Colorado; that proved oil shale could be produced in an environmentally friendly and economic way. They estimate the Green River oil shale could ultimately produce 500 to 1,100 billion barrels of recoverable oil using their technique. Compare that to the 1,242 billion barrel estimate in table 1.

Oil sands are normally estimated separately because they are very heavy oil (bitumen) and sometimes mined, rather than produced with wells. Oil sands were produced in China 800 years ago. The most famous oil sands are those in the Athabasca region of Alberta, Canada. They produce economically from a variety of techniques. About 20% of the production is from surface mines and 80% is from in-situ steam flooding.

Using the BP world-wide annual oil and gas consumption rate for 2015 of 151 million barrels of oil-equivalent per day, the table calculates how many days and years each supply will last. These are “technical reserves” and price is not a factor in their calculation, except for the “proven” category. The total reserve is eight trillion barrels of oil-equivalent for the whole world and a supply that should last at least 148 years. The reserve is very conservative since it only relies on existing technology, remember only 132 years ago, a partner in Standard Oil proclaimed he would drink every gallon of oil found west of the Mississippi! It was innovative oil and gas technology that found billions of barrels of oil-equivalent west of the Mississippi. What will we invent and discover over the next 132 years? Consumption of oil and gas will probably increase over the next 25 years according to ExxonMobil’s 2017 Outlook. This is because they do not expect renewables and nuclear to increase in capacity as fast as demand will grow. But, for simplicities sake, I assumed oil and gas consumption would stay flat for this table.

The moral of the story? Never underestimate the ingenuity of mankind and never assume that technology is static. Also, the resources that technology recognizes today are not all the planet’s resources. There is oil west of the Mississippi!