June 22, 2015

In eight days the Export-Import Bank of the United States will close its doors.

Referred to as the Ex-Im Bank, it was initially created as part of the New Deal in 1934 at the hands of President Franklin Delano Roosevelt in order “to assist in financing the export of American-made goods and services.”

It turns out that “in 1945, the Government Corporation Control Act required the bank to be reauthorized by Congress periodically. Since that time, the Bank has been reauthorized 15 times. The most recent reauthorization, in 2012, passed — 330-93 in the House and 78-20 in the Senate.”

Congress must reauthorize this Bank before June 30 or it will shut down.

And, it seems that according to POLITICO, “the Export-Import Bank is almost certain to close its doors for the first time in history this summer, dragged down by presidential politics and a bitterly divided GOP…”

But don’t despair, because those that support this Bank, including Republicans, are sure to try to revive it later this summer, an effort that, POLITICO writes, “will cause a major rift within the GOP.”

Well, it already has –– and, as usual, House Speaker Boehner is caught in the crossfire. The Hill, on June 7 noted the following:

Speaker John Boehner (R-Ohio) is caught between his lieutenants and Senate Majority Leader Mitch McConnell (R-Ky.) when it comes to the reauthorization of the Export-Import Bank.

While McConnell, House Majority Leader Kevin McCarthy (R-Calif.) and House Majority Whip Steve Scalise (R-La.) have all endorsed letting the bank’s charter expire on June 30 — as have many of the party’s presidential hopefuls — Boehner has declined to take a position.

Meanwhile, Conservative critics of the Bank, which include Club for Growth, Heritage Action and the Americans for Prosperity organization, want the Bank to die, while the U.S. Chamber of Commerce and others are fighting to keep it alive.

Senator Rubio, in fact, has been publicly vocal about the Ex-Im Bank: “The government should not be picking winners and losers when it comes to the free market,” he stated –– denouncing the Bank “as an engine of corporate welfare and cronyism,” reported the Daily Signal.

The former Secretary of State and Democrat presidential front runner (out of three candidates) Hillary Clinton, in May “unloaded” on her GOP foes over the Ex-Im Bank, whereas Time.com released some of her harsh criticism:

Clinton said the bank’s opponents are looking to score political points and are shameless panderers “who really should know better.”

“Across our country, the Export-Import Bank supports up to 164,000 jobs,” Clinton said. “It is wrong that Republicans in Congress are trying to cut off this vital lifeline for American small businesses. … They would rather threaten the livelihoods of those 164,000 jobs rather than stand up to the tea party and talk radio.”

Currently, the U.S. Ex-Im Bank states that it was “founded to sustain and maintain American jobs by supporting the export of U.S. goods and services to foreign buyers.”

And of course, under President Obama, the Ex-Im Bank spending has skyrocketed.

So why all the ruckus?

Well, besides Rubio, “critics say the Bank is the epitome of cronyism, corruption and corporate welfare,” wrote Adam Andrzejewski, contributor at Forbes and the chairman of the nonprofit watchdog organization American Transparency.

Even as the Ex-Im Bank is continually touted as “an independent federal agency that finances the sale of U.S. exports through a variety of financial options,” claiming that it makes a profit, others find this absurd, describing the Bank’s profits as “an accounting illusion.”

Open the Books, an online database of local, state and federal spending founded by Adam Andrzejewski, examined data from the Export-Import Bank available from 2007 and 2014. It found that the bank backed more than $172 billion in loans, loan guarantees and insurance contracts provided to close to 7,000 exporters. Taxpayers, according to the report, are on the hook for $140 billion in financing.

The Daily Signal goes on to counter the claims made by the Bank as well as its advocates:

Contrary to the arguments from Ex-Im’s opponents, those who support the bank and its reauthorization say it helps small business compete in the global market and creates jobs in the United States.

According to the bank, 90 percent of its transactions supported small businesses in 2014.

However, analysis by The Heritage Foundation and George Mason University’s Mercatus Center found that in dollars, small businesses benefit from less than 20 percent of Ex-Im’s financing.

In an April 2015 study by Veronique de Rugy, a senior research fellow at the Mercatus Center, we find this:

Ex-Im Bank advocates emphasize its importance to small businesses and economic growth. A new analysis of government data reveals that Ex-Im Bank’s top 10 overseas buyers are large corporations that primarily purchase exports from multinational conglomerates. Ex-Im Bank’s small business narrative is challenged by the fact that the buyers receiving the most subsidies are—like the exporters—major corporations.

Corporate welfare, all right.

All you have to do is mosey over to the Washington Examiner to find the “Ex-Im Bank Deal of the Day,” provided by Tim Carney, which will give you some insight into the insanity.

- Chinese state-owned bank gets $75M loan from U.S. to buy private jets from Goldman

- Australian exec lives large on loan, goes bankrupt, U.S. taxpayers could eat $150 million

- $650M loan to Australia’s richest woman, hurting U.S. miners

Moreover, Lachlan Markay of the Washington Free Beacon elaborates on de Rugy’s study, whereas in identifying the top foreign-owned beneficiaries of Ex-Im financing, there are “a number of them that have either donated to the Clinton Foundation or received government-guaranteed loans from a bank that has.”

Worse, according to Carney, “The Export-Import Bank is the International Bank of Clinton,” noting that Hillary would like “to put Ex-Im Bank on steroids.” But the reason has nothing to do with small business or jobs. Carney exposes Ex-Im’s recent history, which connects the Clintons to the Banks’ “deals, its staff, and its revolving-door alumni.”

Worse, according to Carney, “The Export-Import Bank is the International Bank of Clinton,” noting that Hillary would like “to put Ex-Im Bank on steroids.” But the reason has nothing to do with small business or jobs. Carney exposes Ex-Im’s recent history, which connects the Clintons to the Banks’ “deals, its staff, and its revolving-door alumni.”

Jordan went on to underscore the revolving door working inside the Bank, providing key examples such as the Boeing Company, as well as Ex-Im Bank employees, including those tied to green energy firms.

It turns out that Michael Whalen, whom in January 2012 joined Ex-Im Bank as Vice President of Structured Finance, worked as the chief financial officer of SolarReserve –– a politically-connected green firm that won a $737 million Energy Department stimulus loan, and “has been a candidate for Ex-Im financing.”

There’s also Tom Kiernan, CEO of the American Wind Energy Association (AWEA), who in 2015 joined the Bank’s Advisory Committee and whom Jordon stated, “represents many companies that have received Ex-Im support.”

Michael T. McCarthy, the Deputy Inspector General (IG) of the Export-Import Bank also gave some chilling criminal testimony surrounding the Bank:

Since 2009, OIG investigative efforts have resulted in a number of law enforcement actions against parties who have attempted to defraud the Bank, including 84 criminal indictments and criminal informations; 50 convictions; $255 million in repayments and judgments from fines, criminal forfeiture, restitution, and civil judgments; and 622 referrals of investigative intelligence to OGC for enhanced due diligence.

In fact, last year the Wall Street Journal reported, “Four Ex-Im officials have been removed or suspended over the past few months for suspected kickbacks, gifts, and improper use of leverage to secure favorable contracts for businesses.”

And just recently (April 22, 2015), one of those four –– a former loan officer at the Export-Import Bank, Johnny Gutierrez –– “pleaded guilty in federal court for accepting more than $78,000 in bribes in return for recommending the approval of unqualified loan applications to the bank, among other misconduct.”

Nevertheless, this Green Corruption File, Inside Job: Export-Import Bank financing themselves, their friends and Obama-Clinton wealthy ‘green’ cronies –– with many of the Bank’s deals fitting more than one category –– will verify and expand upon the cronyism and corruption charges made against the Bank by providing more evidence in the arena of renewable energy.

Under the Obama administration and even while Hillary was secretary of state; billions (I tracked about $5-6B) in financing from the Ex-Im Bank went to green (clean, renewable, alternative) energy deals tied to droves of wealthy cronies of both President Obama and Mrs. Clinton. This includes big bundlers, donors and supporters of President Obama, as well as donors, friends and lobbyists of the Clintons and their foundation.

Worse is that there are those that worked inside the Bank –– specifically the Ex-Im Advisory Board –– whose companies scored big Ex-Im green deals, prior to, during and after their time at the Bank.

This post will also share how the Ex-Im Bank financed green energy failures by digging to eleven firms that we know of, yet exceeds $330 million in the Bank’s transactions with them.

Let’s begin this journey by looking inside the explosive Ex-Im Bank American Transparency Report where we find the following key points:

- TOP 50 Exporters using Export-Import Bank (EX-IM) accounted for over $106 billion in financing

- The five largest are Boeing Company ($60.1 billion); General Electric ($5.997 billion); Bechtel Power Corp. ($4.675 billion); CBI Americas Inc. ($3.215 billion); and Exxon Mobil ($3.0B)

- TOP Fifty Importers (overseas buyers) of U.S. goods and services received low-cost, U.S. taxpayer backed financing accounting for nearly $80 billion. EX-IM financing is heavily concentrated in two industries, as 45 of the TOP 50 importers are comprised of foreign airlines (29) and energy companies (16).

- Incredibly, 18 of the TOP 50 Importers were “owned” by 11 foreign governments and received $26.39 billion in EX-IM financing on 130 transactions. Total financing by government: Mexico ($8.13B), India ($4.299B), United Arab Emirates ($3.90B), China ($3.35B), Ethiopia ($1.93B), Saudi Arabia ($912.84M), Colombia ($880.21M), France ($844.39M), South Africa ($805.58M), Kuwait ($626.217M), and Switzerland ($700M).

- EX-IM on steroids: 248% increase FY 2008 ($14.4B) – FY2012 ($35.8B) Financing rose 61% during the three year period (2011-2013) vs. the period (2008-2010). EX-IM financing amounted to $12.6B (2007), $14.4B (2008), $21.0B (2009), $24.5B (2010), $32.7B (2011), $35.8B (2012), and $27.3B (2013).

Ex-Im Bank Financing Droves of Obama-Clinton Wealthy “Green” Cronies

The chairman and president of the Export-Import Bank, Fred P. Hochberg, whom has been in charge since June 2009, bundled at least $100,000 for Obama’s 2008 winning presidential campaign.

Besides the fact that the Clinton’s have a shady history

with this small Bank, they have big connections to those operating

inside, starting with its current leader. According to the Free Beacon,

“Hochberg is a long-time supporter of Clinton’s political efforts. He is

a prominent Clinton donor and fundraiser, and has also contributed to the Clinton Foundation [between $10,000 and $25,000 with some as recent as 2014].”

Moreover, as the Washington Examiner exposed: “The Clinton-Ex-Im revolving door is well

used, as Bill Clinton acknowledged at the 2012 Ex-Im conference. “This

audience is full of people who once worked for me,” Clinton said, naming

a handful of Clinton White House alumni who now work at — or profited

from — Ex-Im.”

Needless to say, Mr. Hochberg is in line with President Obama’s “green agenda” and its subsequent revolution costing taxpayer $200 billion and counting. And, since 2008 “the Bank has a Congressional mandate to support renewable energy

and has been directed that 10% of its authorizations should be dedicated

to renewable energy and environmentally beneficial transactions.”

The Ex-Im Bank not only finances key industries

such as Oil and Gas, Mining, Agribusiness, Medical Equipment and

Services, Construction Equipment and Services, Aircraft, as well as

Power Generation and Related Services, it’s also is in the “green

business.”

Why the massive discrepancy with the Bank’s green energy and sustainability portfolio?

Well,

the answer to that is also found in the aforementioned study, which

boils down to “lack of transparency and accuracy in their data

reporting.”

For instance, green projects to fund

solar panel manufacturing are at different times categorized as “All

Other Miscellaneous Manufacturing,” “Commercial, Industrial, And

Institutional Electri [sic],” or “Nonclassifiable Establishments,”

depending on who inputs the data.

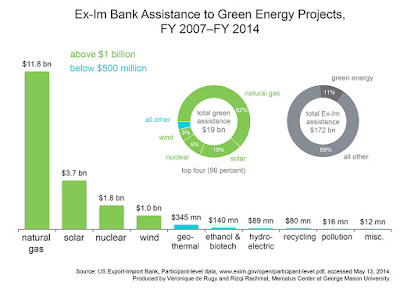

the Mercatus Center separates the $19 billion into three categories:

$11.8 billion natural gas, $1.8 billion nuclear and $5.4 billion for all

the rest such as solar, wind, geothermal, ethanol and biofuels,

hydroelectric, recycling, pollution management and prevention, and

miscellaneous.

The

first chart displays the total estimated Export-Import Bank assistance

that was doled out to green energy- or sustainability-related firms and

projects from FY 2007 and FY 2014. It shows that natural gas-related

projects received the largest amounts in Export-Import Bank assistance

of all green energy projects. Natural gas projects received $11.8

billion in assistance from FY 2007 to FY 2014, or 62 percent of the

green portfolio. Solar energy comes in the second spot with $3.7 billion

in assistance, or almost 20 percent of the portfolio. Nuclear projects

received roughly $1.8 billion in assistance, or almost 10 percent of the

portfolio, while wind projects received $1 billion in assistance, or

5.4 percent of the total. Geothermal, ethanol and biofuels,

hydroelectric, recycling, pollution management and prevention, and

miscellaneous projects all constitute less than 2 percent of the

portfolio.

Even if you eliminate the natural gas and nuclear

projects, that still leaves $5.4 billion in green energy spending.

Nevertheless, here we have another “green bank” that not only risks

American taxpayer money on renewable energy in other

nations, but as you will discover, droves of President Obama’s favored

green energy friends are also being propped up by the Ex-Im Bank. The

kicker here too is that most of these same cronies also have ties to the

Clintons, which is why Hillary is “championing” this Bank

Considering that the Clinton Foundation has been pushing climate change for sometime, along with their Clinton Climate Initiative (CCI), last month I unleashed an overview on how many of the same “green corruption players” are also donors

to the Clinton Foundation. These are those individuals and companies

that were big campaign bundlers and donors (some even catapulted to

advisors) for Obama as well as other high-ranking Democrats that scored

billions of “green” cash from the Obama administration.

At a quick glance, this includes Bill & Melinda Gates Foundation (tied via Sapphire Energy), Duke Energy, NRG Energy, Goldman Sachs, Open Society (George Soros), Citigroup, General Electric, Google, Soros Foundation, Alcoa Inc, Bank of America Corporation, CH2MHill, Solazyme, Tom Steyer, Heather Podesta, NextEra Energy, Nissan North America, Inc, Enphase Energy, and General Motors Company. There’s also AREVA, L. John Doerr, First Solar, Honeywell Inc, Elon Musk, Pepco Holdings, Inc, Suntech Power Holdings Co., Ltd, U.S. Geothermal Inc, Good Energies, Pacific Gas & Electric Company, Silver Spring Networks, Solar Millennium AG, Southern Company, the AES Corporation, and more.

In the mix are radical left-wing individuals and groups that participated behind the scenes, such as Carol M. Browner, the Joyce Foundation, and the Tides Foundation, as well as many other Clinton Foundation donors that are in the green energy business worthy of investigation.

Since

that time, additional donors to this so-called charity have been discovered,

which is relevant this Green Corruption File –– those

that have worked inside the Bank as well as those that “cashed in” from its

renewable energy financing.

What’s very disturbing is that the 2014 Mercatus Center report mentioned earlier, which charts the “Export-Import Bank’s Green Portfolio” (FY 2007 and FY 2014), also tracks the common practice committed by many of these politically-connected firms referred to as “double dipping,” which portrays an ugly portrait of how these big corporations leach off of American taxpayers through more than one government agency.

Big Obama-Clinton Pal, General Electric, makes Bank off of the Ex-Im Bank –– even the “green”

|

| President Obama’s Job Council: CEO of GE Jeffrey Immelt left as the “Jobs Czar” |

According to the 2014 Mercatus Center report, “General Electric received the highest amount of combined assistance, with $20.7 billion coming from the Export-Import Bank and $3.9 billion from the [1705] loan program for a total of $24.6 billion.”

EX-IM supported a $2 billion transaction between GE and Reliance Infrastructure – one of the largest business houses in India (2012).

GE purchased [August 2013] ABW Solar after EX-IM extended long-term loans of up to 18 years to build three solar photovoltaic power projects in southwestern Ontario for $236.72 million [in September 2011].

While the ABW Solar transaction is also part of the First Solar deals that occurred in September 2011, GE also benefited from the $78.6 million deal that Abengoa scored in December 2012 from the Ex-Im Bank to purchase GE products for a power project in Mexico.

And, “Despite Clinton’s claim that Ex-Im is designed to help small businesses, the largest beneficiary of Ex-Im subsidies is airline giant Boeing, which has donated between $1 million and $5 million to the Clinton Foundation. Another top beneficiary, General Electric [GE], has given between $500,000 and $1 million [some of which occurred in 2014],” noted Markay.

Here’s the short version:

There’s also Jeffrey Immelt, a friend of former President Clinton (seems Bill had him on speed dial while Bill was president and needed to change his light bulbs), whom is the CEO of GE, which also had direct ties to President Obama via big campaign donations and more.

In 2008 GE gave the Obama campaign $529,855, marking them as a top donor, while in early 2009 Immelt was first appointed as a member of Obama’s Economic Recovery Advisory Board (PERAB), which later morphed into the president’s jobs council, where Immelt served as the Jobs Czar –– until it closed down in February 2013.

Needless to say, GE “made bank” off of the president’s green energy stimulus funds, of which the last time I checked (December 2012), it was over $3 billion and counting.

In 2009 the New York Times recognized GE’s green power, noting, “GE lobbied Congress to help expand the clean-energy subsidy programs, and it now profits from every aspect of the boom in renewable-power plant construction, including hundreds of millions in contracts to sell its turbines to wind plants built with public subsidies.”

In fact, you’ll be “blown away” by the billions of wind-energy grants that flew out of the stimulus package back in February 2010, of which GE is contracted to at least 26% of them as the “turbine manufacturer.

NOTES:

- Both the 2014 Mercatus Center Report, The Export-Import Bank’s Green Portfolio Benefits Familiar Firms and 2015 Green Energy Sector Micro Report by American Transparency, as well as my extensive research in this area (following the “green” money, which began in late 2009, will be main sources for this Green Corruption File

- Red denotes Ex-Im Bank Green Energy Crony Deals (stand alone or cumulative)

Ex-Im Advisory Board Doling

out “Big Green Deals” to Themselves and Their Friends

Last January, the Daily Caller exposed the fact that the Ex-Im Bank had appointed all of its friends to their 2015 Advisory Committee –– a panel that “advises the Bank on its policies and programs.”

Also, Lachlan Markay of Washington Free Beacon early this year took note: “The ‘revolving door’ between Ex-Im and the companies and trade associations that benefit from the goodies the agency provides remains a common practice that critics say raises ethical questions.”

While some surmised that this “shows that corporate welfare is institutionalized within Ex-Im,” here’s an example:

…former Washington Gov. Christine Gregoire, who will return as chairwoman of the Committee, has a history of supporting the interests of Boeing, which has been the foremost beneficiary of Ex-Im financing in recent years.

The following will dig deeper into this advisory board and how its members benefited from the Bank’s green energy assistance –– before, during and after their time at the Bank.

SpaceX Scores Hundreds of Millions from Ex-Im Bank, Adds them to their Advisory Board: Founder & CEO Elon Musk, big Obama “green crony” & Clinton Foundation donor

|

Photo from Space News: SpaceX CEO Elon Musk, shown above

left speaking with Fred Hochberg, president and chairman

of the U.S. Ex-Im Bank, at the bank’s 2014 conference.

And here is the boring video.

|

While there are plenty of others that deserve scrutiny, we’ll stay with the Obama-Clinton “green”

cronies.

This is where it gets fun, because in snooping around, we find that in 2014, Gwynne Shotwell, the President and COO of SpaceX –– billionaire Elon Musk’s rocket company –– became part of the Ex-Im Bank advisory committee and stayed on in 2015.

In case you don’t know Elon Musk, let me share: He is one of President Obama’s billionaire buddies and donors. And while he has given generously to Republicans in the past, he is also a major DNC contributor. Musk has donated between $25,000 and $50,000 to the Clinton Foundation.

The taxpayer-subsidized billionaire is tied to two huge Obama green energy deals: The Tesla Tale and SolarCity Story, of which here are some key reminders:

- In 2004, Musk not only funded the electric-car start up, but he also joined Tesla Motors Board of Directors as its chairman –– and he is currently the CEO. Tesla, in January 2012 received a $465 million from the Energy Department’s Advanced Technology Vehicles Manufacturing (ATVM) loan program. Not to mention this electric car company benefits from federal and state special tax breaks for each car sold.

- Musk is also SolarCity‘s chairman and largest shareholder, which is another huge winner of “green” taxpayer funds from the Obama administration. In fact, SolarCity, since September 2009 (and as of July 2012) has snagged anywhere from $514 million to $1 billion in grants and special tax breaks, which includes free cash from the stimulus-enacted 1603 Grant Program –– which as noted earlier, has dished out $23.7 billion of American taxpayer money.

Since we’ve have been tracking both of these big green deals, below are the latest Green Corruption Files on them, which not only involve Musk, but two key additional billionaire friends of Obama: Nicholas J. Pritzker, whom is the cousin of Penny Pritzker, our Commerce Secretary and who happens to be an Ex-Im Board Member, ex officio.

- February 17, 2015 –– Obama Administration Fueling Friends and Failure: At least $10 billion of taxpayer money blown on ‘green’ cars, NOT so ‘green’

- July 12, 2014 –– SolarCity: Subsidizing the Left’s ‘green’ millionaires and billionaires

Still, those ties are just the beginning. There are numerous Obama-Clinton cronies connected to these particular green deals that will be expanded upon later under the “Ex-Im Board Member, ex officio” section.

Needless to say, Tesla and SolarCity are also not the only taxpayer-subsidized projects of Mr. Musk. In 2013 his rocket company, where he is the founder and CEO, scored mega-cash from the Ex-Im Bank: $524.9 million and $105 million.

According to their website, “SpaceX is a private company owned by management and employees, with minority investments from Founders Fund, Draper Fisher Jurvetson, and Valor Equity Partners.”

Ex-Im loans money and guarantees private bank loans — at taxpayer risk — to Musk’s overseas customers. For instance, Ex-Im approved more than half a billion dollars in loans in Fiscal 2013 to satellite providers in Hong Kong. This subsidized the purchase of satellites made in the U.S. by Boeing and Loral and launched by SpaceX rockets, which are also made in the U.S. Israel separately got a $105 million loan [August 23, 2013] to use SpaceX to launch its Israeli-made satellites equipped with U.S.-made solar arrays.

PARIS — Satellite broadband hardware and services provider ViaSat Inc. on March 13 said it had concluded terms for a $524.9 million direct loan from the U.S. Export-Import Bank to cover the costs of the ViaSat-2 Ka-band satellite to be launched in mid-2016 from Florida.

SpaceX in 2008 inked a $1.6 billion deal with NASA for 12 missions to the International Space Station, and has deals with commercial satellite companies for launches. The first SpaceX cargo mission to the ISS launched in October 2012. But by that time, SpaceX had already received hundreds of millions of dollars from NASA. Through mid-2011, NASA had paid SpaceX $298 million for meeting milestones, and Musk in April 2012 said, “I think we’ve received about $400 or $500 million in NASA funds so far.”

Finally, in May 2015, Jerry Hirsch of the LA Times (found at Fusion4Freedom), in noting all three companies (Tesla, SolarCity and SpaceX), exposed the fact that “Elon Musk’s growing empire is fueled by $4.9 billion in government subsidies.”

Elon Musk’s SpaceX announced that Google and Fidelity Investments had acquired just under 10 percent of the privately held company for a total of $1 billion. The investment values the reusable-rocket company at about $10 billion.

First Solar, Big Obama Crony, Clinton Foundation Donor & Ex-Im Advisory Board Member: Huge winner of Obama “green cash” that also raked in over $600 million in “green” Ex-Im Bank financing

Also in 2014, the Bank added James Hughes the CEO of First Solar to represent “the environment.” But before Mr. Hughes, there was Michael Ahearn –– a big Democrat donor, whom is now at True North Venture Partner, but is First Solar’s founder and chairman, who served as interim CEO from October 2011 until May 3, 2012 when they appointed Hughes. Ahearn continues in his role as Chairman of the Board at First Solar.

Nevertheless, it was Ahearn that was caught in the middle of the “First Solar Swindle” that Marita Noon, energy columnist, and I exposed back in 2012, which was updated in March 2013.

Moreover, according to the March 2012 House Committee on Oversight and Government Reform Report, which has been a main source in unleashing the truth about the Department of Energy (DOE) Loan Guarantee Program and its subsequent cronyism and corruption, “First Solar has gained a unique advantage relative to its peers by mastering its relationship with government.”

Considering that First Solar was the beneficiary of at least five Ex-Im loans for green energy projects, it’s worth noting that their wealthy key investors happen to be Obama cronies, with many Clinton “friends” in the mix. These include the mega-bank Goldman Sachs as well as the liberal billionaire George Soros that are both big Clinton Foundation donors.

#1) March 2011, $19 million India:

“Ex-Im Bank also authorized a $19 million loan guarantee to PNC Bank in Pittsburgh, PA, for a long-term fixed-interest rate loan supporting sales of thin-film solar modules by First Solar Inc. to a 15-MW solar power plant in the state of Gujarat.”

#2) July 2011, $16 million India:

What’s interesting here is that according to the Washington Free Beacon, “Diane Farrell, who served on the Board of Directors of the U.S. Export-Import Bank [since 2007] and was a Democratic congressional candidate in Connecticut,” in early 2015 joined the board of Azure Power.

Additionally, the Free Beacon notes her Ex-Im capacity: “agency records show [that] Farrell voted to approve a $15,776,702 loan to Azure…”

The Free Beacon continues:

The move came days before the Obama administration announced plans to expand U.S. support for India’s solar industry, which will include extensive U.S. taxpayer backing for companies such as Azure.

Farrell’s public sector experience, and her subsequent position at a division of the U.S. Chamber of Commerce that seeks to increase business ties with India [and is pushing to reauthorize the E-Im Bank], could give Azure a leg up in securing some of the $1 billion in Ex-Im loans for Indian companies purchasing U.S.-made solar power technology.

#3) August 2011, $84.3 million India:

In November 2011, the following was heralded: “The Export-Import Bank of the United States (Ex-Im Bank) approved $103.2 million in financing for two more solar transactions in India in the final months of fiscal year 2011. The approvals brought the total number of Indian solar projects that the Bank has financed in FY 2011 to six and the Bank’s total authorizations for these projects to $176.4 million.”

And once again, First Solar was part of the transaction: “On August 25, 2011, Ex-Im Bank’s board of directors approved an $84.3 million direct loan to Dahanu Solar Power Pvt. Ltd. supporting the purchase of thin-film solar panels from First Solar Inc. and other U.S. exports for the construction of a 40-MW photovoltaic (PV) solar-power plant in the state of Rajasthan, India.”

#4) September 2011, $455.7 million Canada:

The Bank and First Solar both boast that at the manufacturing facility tour of First Solar Inc. in Perrysburg, Ohio, which was held on September 1, 2011: “Fred P. Hochberg, chairman and president of the Export-Import Bank of the United States (Ex-Im Bank) announced the Bank’s authorization of two transactions totaling $455.7 million to support First Solar’s exports to solar-energy projects in Ontario, Canada.”

While the First Solar Ohio plant had been subsidized (via other green energy federal and state programs: $17.3 million in government grants and $15 million in government loans), this particular “green” deal is even more convoluted, because, part of this taxpayer-backed $455.7 million Ex-Im Bank loan enabled First Solar to sell solar panels to itself –– a bombshell that was exposed in early March of 2012 at the Washington Examiner:

A small corporation called St. Clair Solar owned the solar farm and was the Canadian company buying First Solar’s panels. But St. Clair Solar was a wholly owned subsidiary of First Solar. So, basically, First Solar was shipping its own solar panels from Ohio to a solar farm it owned in Canada, and the U.S. taxpayers were subsidizing this “export.”

At that time (March 2012), First Solar unloaded its St. Clair solar farm to NextEra Energy,

the third largest power company in the world, which is also the third largest recipient of the Energy Department’s risky stimulus loans, that was briefly mentioned earlier as part of one of First Solar’s DOE deals and a Clinton Foundation donor, who we know has been in cahoots with First Solar for some time, including in Canada.

On July 18, 2012, the Ex-Im Bank “authorized a pair of loans totaling $57.3 million to Solar Field Energy Two Private Ltd. and Mahindra Surya Prakash Private Ltd., respectively, to finance the export of American solar panels and ancillary services to India.”

And once again, “the solar panels, which are manufactured by First Solar Inc. of Tempe, Ariz., will be used in the construction of solar photovoltaic plants in Rajasthan, India,” with the Bank bragging that “these transactions will support 200 U.S. jobs at First Solar’s manufacturing facility in Perrysburg, Ohio.”

Additionally, early this year, the Heritage Foundation noted that “First Solar is expected to be one of the green energy firms that receives loans and loan guarantees through Ex-Im’s $1 billion partnership with India.”

On a side note…

In 2013, Steve Wilburn, CEO of FirmGreen Inc., representing “environment,” joined the Ex-Im Advisory Board (he was appointed), where he continued on in 2014.

In 2013 they received the Bank’s Renewable-Energy Exporter of the Year award, and in 2014 they hosted Ex-Im Bank Chairman and President Fred P. Hochberg at their headquarters in 2014 “to discuss FirmGreen’s growing portfolio of patented green technology…”

Of course, as the pattern goes, this “advisory role” occurred after his company FirmGreen, “a small renewable-energy company based in Newport Beach, CA,” scored $48.6 million in Ex-Im financing for “U.S. green-technology exports to a biogas project in Brazil.” However, there

are members whose firms or their invested interests snagged deals from the Bank while –– and even after –– they served on the Bank’s board, which screams corruption!

Bill Richardson & Carol Browner: Two Key Ex-Im Advisory Board Members with close ties to numerous Ex-Im “green” deals –– both from the Clinton administration and Clinton Foundation donors

|

Photo from the New York Times: 2008 President-elect Obama

announces Gov Bill Richardson as his Commerce Secretary

|

While the American Transparency (OpenTheBooks.com) Ex-Im Bank Green Energy Report documents that the Spanish company “Abengoa has obligations of over $225 million in EX-IM support,” I found three transactions that occurred in 2011 until September 2013 that exceeds $260 million.

Before we dig into that, it’s important to point out that American taxpayers, workers and vendors “got burned” by this well-connected Spanish conglomerate that not only benefited from the Ex-Im Bank, but snagged billions stimulus loans from the Department of Energy (DOE) as well as stimulus grants from the Treasury Department –– a bombshell story we exposed last year via droves of whistleblowers, some of which went public at the Washing Free Beacon last summer.

Abengoa was the second largest recipient of DOE’s 1705 green loans. The Spanish company, between July 2010 and September 2011, received $2.8 billion to construct two solar energy complexes in Arizona (Solana) and California (Mojave), and a biofuel plant in Kansas. For comparison, observe that this is over five times the amount received by the notorious Solyndra ($535 million). Abengoa received an additional $818 million in special green energy stimulus grants, bringing the total to $3.6 billion of taxpayer money.

As usual, these DOE deals carry key connections, which was divulged in my March 30, 2014 SPECIAL REPORT: Inside the Obama Administration’s Big Green Energy Deals With Abengoa.

Moreover, President Obama, early on had tapped the political ambitious of Mr. Richardson by appointed him to be his secretary of commerce; however, “tarnished by scandal,” he withdrew his nomination. Ironically, this was a pay-to-play scheme that dragged on for some time until some sort of financial settlement occurred in July 2013 –– “with no criminal charges filed in the alleged scandal, and Richardson and Vanderbilt officials [the other culprit] have denied wrongdoing,” reported the Washington Examiner.

Back in 2012, when we began to unravel the Abengoa cronyism, corruption and collusion, we had exposed the fact that Richardson joined Abengoa’s advisory board in March of 2011 — which is reportedly a paid position. At that time, we noted that Abengoa CEO Manuel Sanchez Ortega, felt that Abengoa was “extremely fortunate” to have Richardson’s “extensive knowledge of the renewable energy sector and his background in public policy.” Richardson is currently listed on the Abengoa International Advisory Board.

More alarming is that Richardson was also listed as a 2013 Ex-Im advisory board member. Yet, he doesn’t brag about his role there –– not even on is bio. Obviously, holding a seat on both Abengoa and the Ex-Im Bank advisory boards as the Spanish firm rakes in hundreds of millions of dollars (before and during Richardson’s stint at the Bank) not only smells like a “conflict of interest,” it reeks of corruption.

At any rate, the following are three Ex-Im Bank “green” deals benefiting Abengoa, which exceeds $267 million:

#1) 2011: $83 million for a solar plan in Mexico:

We also know, that according to the Free Beacon, “Richardson is also connected to Diane Farrell, a former Ex-Im Bank director [mentioned earlier, whom in 2015 joined the board of Azure Power that is tied to the Bank’s deals with First Solar]. Richardson headlined a fundraiser for Farrell’s 2004 congressional campaign that was expected to bring in $300,000. She voted to approve a final commitment on an $83 million loan to Abengoa for a [solar] plant in Mexico while still a director in 2011.”

Now, I haven’t been able to locate this $83 million Ex-Im Bank transaction, but there’s more.

#2) 2012: On December 18, 2012 the Ex-Im Bank provided direct loans to Abengoa worth over $150 million for two projects as follows:

Uruguay – Palmatir S.A., $73.6 million

The Bank’s press release stated, “Ex-Im’s loan will support the purchase of 25 wind turbines from Gamesa Technology Corporation, which has its North American headquarters in Trevose, PA. The loan will also help to finance ancillary services and local costs in Uruguay associated with construction of the wind farm.”

It should be noted that both candidate Obama (in 2008), and President Obama (in 2011) toured –– more like campaign rallies –– Gamesa Technology Corp. wind turbine manufacturing plant in Fairless Hills Pennsylvania, touting alternative energy and green jobs. However, just over a year later (the summer of 2012), Gamesa laid off 165 workers at two of its Pennsylvania production facilities, one of which Obama had visited. Considering the timeline of the Ex-Im Bank loan –– approximately four months later –– one has to wonder if this $73.6 million loan (or was it $72.6 million?) was also a bailout.

Needless to say, in a 2013 Ex-Im Annual Report, we find that Gamesa Technology Corp. in Pennsylvania was privy to nearly $160 million in Ex-Im loans, which not only include the project in Uruguay, but also in Honduras and Costa Rica.

And let’s not forget that according to the 2014 Mercatus Center “green firm” study, the Spanish wind energy giant Gamesa is a favorite of the Ex-Im Bank: “It received a combined $1.3 billion.”

Mexico – Abengoa S.A., $78.6 million

The Bank’s press release goes on: “The Bank’s loan to Abengoa S.A. will support the purchase of three GE 7FA gas turbines and two generators for the use in the 642 MW Centro Power Project in Morelos, Mexico. The American exports will be used to help build a power plant for Mexico’s public electric utility. Approximately 350 jobs at GE are supported by the Bank’s financing.”

While the Bank justified this $150 million deal by claiming that it was a means to export American-made energy equipment and to support American jobs, in reality, it only propped up Abengoa (both directly and via Gamesa) as well as another big green corruption player, GE, which was profiled much earlier in this post.

In September 2013, the Washington Free Beacon reported that “The Ex-Im Bank recently authorized a pair of loans totaling $33.6 million to Abengoa — a Spain-based energy company — that will fund the export of American-made products for use in solar projects in Spain and South Africa.”

Needless to say, we can confirm that at least this transaction occurred while Richardson was a member of Ex-Im Bank advisory board, however, the Heritage Action, in January 2013 reported that “An Ex-Im Bank spokesman said that Richardson had no communication or role with anyone at the Bank regarding this transaction.”

OK, the December 2012 transaction? Hmmm.

There are a few other players caught up in the middle of the Abengoa DOE deals, such the big bank Citigroup, the mega-energy company Pacific Gas and Electric (PG& E), and the ultra-rich California Democratic Senator Dianne Feinstein, of which all three are Clinton Foundation donors. Citigroup donations range between $500,000 to $1 million and both PG&E and Feinstein contributing between $10,000 and $25,000, of which both Citigroup and PG&E had done so in 2014.

As usual, in the mix we find Al Gore, whom along with his ultra-rich climate minions, are key operatives inside this green energy scam. Gore is also pal of Richardson. In fact the two go way back.

And, Gore is no stranger to “bringing home the green” (taxpayer money that is) –– as reflected inside this January 2013 post entitled, Green Bank of Obama: John Doerr and Al Gore of Kleiner Perkins, scores billions in ‘green funds’.

They are also tied to the Clinton Foundation with Gore being a “featured guest” at their gatherings, while Kleiner Perkins has contributed between $10,000 and $25,000 –– and Doerr and his wife Ann have collectively given between $75,000 to $150,000 to Bill and Hillary’s foundation.

While Gore and billionaire John Doerr go way back, in 2007 the two firms (GIM and Kleiner Perkins) “created an international alliance to accelerate global climate solutions” –– and Gore joined the big VC firm Kleiner Perkins as a partner, while Doerr joined GIM’s Advisory Board.

Between these two firms, this wealthy “climate dynamic duo” –– Gore and Doerr –– are tied to over $10 billion from Obama’s green energy spending spree (loans, grants and special tax breaks, including from the $100 billion stimulus funds earmarked for renewable energy), which includes the Ex-Im Bank’s favorites, both First Solar and Abengoa; however, I yet to do a complete analysis of GIM.

Back then 50 percent (36 of the 66) of the Kleiner Perkins “Greentech Portfolio” were confirmed winners. And while Silver Spring Networks, which happens to be a Clinton Foundation donor (between $10,000 and $25,000), is factored into that percentage, it’s not included in the $10 billion mentioned above. But what’s interesting is that this shining company –– carrying its own IPO scandal –– is also an investment of another Obama friend, Foundation Capital, which back in the summer of 2009 when the Energy Department started dishing out $4.5 billion in smart-grid grants, Silver Spring Networks “customers” raked in $1.3 billion of that money.

However, there are two Ex-Im green energy deals tied to Kleiner Perkins –– Amonix, now Arzon Solar LLC (February/March 2011 for $9 million) and MiaSole (over $62 million in Ex-Im support) –– that fit the loser category, which will be detailed later.

That year Carol Browner was listed as Senior Counselor, Albright Stonebridge Group and Center for American Progress (CAP), “representing the environment.”

Needless to say, Browner was a 2008 Obama bundler and part of the Obama-Biden Transition Team.

Later she was appointed to president’s 2009 Green Team as the “climate czar,” which placed her at the center of green corruption. Browner not only “pushed for billions of dollars for renewable energy in the economic stimulus bill,” she was part of the decision-making process inside the Energy Department’s Loan Guarantee Program, which at the time of her departure had doled out $34.7 billion of taxpayer money –– despite the majority of the loans being junk-rated, including the six big DOE deals that went to Abengoa and First Solar.

In early 2011 Browner abruptly resigned from her climate post. And, what’s relevant here is that in 2013, she served on the Advisory Committee of the Ex-Im Bank.

From 1993 to 2001, Browner served as the administrator of the Environmental Protection Agency under President Bill Clinton –– and she is also a Clinton Foundation donor, contributing between $5,000 and $10,000.

Here we have the industrial conglomerate Siemens that is strategically positioned inside renewable energy sector, and who in 2009 set out to be “green infrastructure giant.”

While Siemens scored “green” stimulus funds, including millions in grants for wind-energy projects (and more) here in the United States, the American Transparency Ex-Im Bank Green Energy Report documents how Siemens Energy not only secured hundreds of millions of cash from the Bank, but also its praise.

Siemens Energy, Inc was chosen by EX-IM as the 2015 Renewable Exporter of the Year and also won the second award, 2015 Renewable Deal of the Year. These awards highlighted the

2014 wind turbine sales to Peru. Since 2007, Siemens has been the recipient of $709.53 million in EX-IM financing with concentration in countries like Mexico, South Korea and Saudi Arabia.

The parent corporate office of Siemens is in Germany. With a market cap of $85.84 billion, Siemens is one of the largest and most influential European companies. It’s telling that EX-IM choose a U.S. division of Siemens as the 2015 EX-IM superstar.

What’s deeply disturbing in this case is that in 2011, the President and CEO of Siemens Energy, Inc. Randy Zwirn joined the Ex-Im Advisory Committee and served in 2012 as well.

In February 2012 Istockanalyst.com recorded that “Ex-Im Bank has financed approximately $1.36 billion in total transactions with the company [Siemens] to date” –– of which at least one of those large deals (where I discovered three, topping $837 million –– some renewable energy) was hatched in 2012 while Mr. Zwirn was on US Export Import Bank Advisory Board.

- South Korea: On July 25, 2010, “Siemens Energy, Inc. won a gas and steam turbine-generator sale to the Republic of Korea for a plant expansion, backed by a $134.2 million long-term loan guarantee from the Ex-Im Bank.”

- Saudi Arabia: On January 10, 2012, the Ex-Im Board “approved a $638 million direct loan to finance the sale by Siemens Energy, Inc. of gas and steam turbines to be installed in Saudi Arabia.”

- Peru: On August 25, 2014, the Ex-Im Bank “authorized a pair of direct loans [$65 million in total] to two wind power projects in Peru [Marcona wind project and the Tres Hermanas wind project] for the export of wind turbines manufactured in Hutchinson, Kan., and Fort Madison, Iowa, by Siemens Energy, Inc.”

Remember Carol Browner (above), a Senior Counselor at Albright Stonebridge, who in 2013 served on the Ex-Im advisory board?

Well, this brings me to another aspect of these “Inside Jobs,” which was exposed on June 9 by Tim Carney:

The Madeleine Albright connection runs deep. Albright, Bill Clinton’s secretary of state, now runs a consulting firm (chair), Albright Stonebridge. Her daughter Alice was COO of Ex-Im from 2009 through 2013. In those years, Siemens — an Albright Stonebridge client — benefited from $772 million in Ex-Im financing. Plenty of Albright Stonebridge employees have also been employees or advisors of Ex-Im.

Sure enough, after Browner, in 2014 Alan Fleischmann, Principal of Albright Stonebridge Group, joined the Ex-Im Bank advisory board. Meanwhile, the Madeleine K. Albright is not only a Clinton Foundation donor, contributing between $50,000 to $100,000, some of which was given in 2014, she’s a regular at the Clinton Global Initiative (CGI) annual meetings, including as a “Program Participant” (2010), a “Featured Attendee” (2012), as well as a special appearance in 2014 …and so on.

But there’s more…

At some point, Mr. Zwirn, the President and CEO of Siemens Energy, also served on the Board of Directors of the nuclear energy conglomerate AREVA.

Now what’s interesting here is that I’ve been reporting on AREVA for some time, starting with the fact that it involved another Kleiner Perkins investment and billions more of Obama bucks.

First, there’s the $2 billion “POTUS approved” 1703 Energy Department loan guarantee that occurred May 2010 and was awarded to AREVA in order to fund the Eagle Rock Enrichment Facility (EREF) in Idaho Falls, ID, which was supposed to support 310 permanent jobs, with 1,000 temporary construction. Yet, as noted a while back, as of May 2013 they were struggling to get this project off the ground. And, in February 2014 it was reported, “AREVA (loan) has not been finalized and construction plans have been indefinitely delayed.” Maybe that’s why the AREVA deal is missing from DOE Loan Program (Portfolio Projects) updated website.

In February 2010 the French nuclear giant AREVA acquired Ausra Inc. (a solar company), of which, at that time, was an investment of both Kleiner Perkins as well as Generation Investment Management (GIM). You know, the dynamic climate duo John Doer and Al Gore profiled earlier.

On July 8, 2010, Ausra was reborn as AREVA Solar, of which, weeks later, they were awarded close to a $14 million 1603 stimulus grant for “solar electricity” in California.

And, the American Transparency Ex-Im Bank Green Energy Report divulges that “Areva Solar North America received nearly $54 million in EX-IM support for its exports to India. All three transactions were for long-term loans of up to 18 years.”

Still, the Mercatus Center 2014 Report, The Export-Import Bank’s Green Portfolio Benefits Familiar Firms, concluded that the “French nuclear conglomerate AREVA, which received $2.1 billion through the 1703 program and the Export-Import Bank.”

This means that the Bank has supported AREVA with well over $100,000 million in green energy deals –– possibly much more.

It seems, that in April 2012, when the Ex-Im Bank approved $80 million in export financing for a solar project in India, is where we find AREVA:

U.S. companies potentially involved in the transaction include AREVA Solar Inc. (Mountain View, Calif.); E.I. DuPont de Nemours and Co. (Wilmington, Del.); Clifford Chance Rogers Wells LLP (Washington, D.C.); 3M Company (St. Paul, Minn.); Sika Corp. (Lyndhurst, N.J.); CCI Corp. (Tulsa, Okla.); Certainteed Corp. (Valley Forge, Pa.); Huck International Inc. (Waco, Texas); and Weed Instrument Company Inc. (Round Rock, Texas).

While the $80.32 million direct loan went for the purchase of concentrated solar power technology by Reliance Power, Ltd. in Rajasthan, India, at that same time, “AREVA Solar was awarded a contract by the Indian group Reliance Power Limited to build a 250 MWe concentrated solar power (CSP) installation in India…”

Two Ex-Im Bank Board Members, Ex-Officio Heavily Linked to “the Green”

Next we have billionaire Penny Pritzker, known as an heir to the Hyatt Hotel fortune, starting with the fact that the Hyatt Hotels Corporation has donated between $25,000 and $50,000 to the Clinton Foundation, some of which they did so in 2014, as well as participating in other activities.

Penny, on the other hand, has been a Chicago friend of the Obama’s since the early 1990’s. In fact, Ms. Pritzker is a longtime supporter of Barack Obama, and even became a key fundraiser for his presidential run in 2008. And while she wore many liberal hats, including prominent positions like the 2008 National Finance Chair of the Barack Obama for President campaign and co-chair of the 2009 Presidential Inaugural Committee, she played a less significant role in Obama’s 2012 reelection. She also gave generously to Democrats in 2012.

Musk is a prominent Obama supporter, and has donated between $25,000 and $50,000 to the Clinton Foundation, while Nicholas, on the other hand, is a partner at Tao Ventures, an investment firm that lists three main companies that are directly tied to Mr. Musk: Tao Capital Partners‘ portfolio in technology includes Tesla, SolarCity, and SpaceX. There’s also Uber, DeepMind, Proterra, Aquion, Crossbar, Illumio, Zenefits, ironSource, Revinate, MJ Freeway.

Even though both Proterra and Aquion have their very own green energy crony tales that deserve further scrutiny, we’ll stay focused on the “Tesla Tale” and “SolarCity Story,” which includes numerous Obama-Clinton “green” cronies, providing further proof that the majority of the green energy wheeling and dealing, including the Ex-Im Bank financing, is scam –– it’s all about access and influence; rather than saving the planet.

The Tesla Tale involves the former DOE Insider and two-time Obama bundler Steve Westly, who was labeled by IWatch as the “Green bundler with the golden touch.” Westly is the Founder and Managing Partner of The Westly Group –– a VC firm that was an early investor in Tesla. It turns out that The Westly Group were big winners in the Obama green energy-spending spree: As of January 2013, out of the 20 firms listed on thier portfolio at that time (exited and current), at least 50 percent scored –– with some making their way into the “green graveyard.”

Spinner is a two-time Obama bundler; he worked for Obama’s 2008 Transition Team; and was part the president’s 2012 reelection campaign, serving as a California finance chair and founded Technology for Obama (T4O).

Furthermore, Spinner was also handpicked to make a cameo appearance at the 2012 Democratic National Convention, along with other wealthy green cronies president: Tom Steyer (Clinton Foundation donor), Jim Rogers (Duke Energy is Clinton Foundation Donor), and Steve Westly.

And while in April 2009, Spinner was appointed as the DOE Loan Programs “advisor” to then-Energy Secretary Steven Chu, by September 2010, he left the DOE and about that same time joined Center for American Progress (CAP), where we found 2013 Ex-Im board member Carol Browner, as a Senior Fellow until October 2011.

Liberal billionaire George Soros (investor in both First Solar and SolarCity), whom not only bankrolled Obama’s campaigns and is a friend of the Clintons, but also has a massive footprint inside green corruption, funds CAP. Last I checked in March 2013, Soros’ “green” Obama deals exceeded $11 billion of taxpayer money.

As noted under First Solar, Soros is a major donor to the Clinton Foundation (via Open Society Institute between $1 million to $5 million and the Soros Foundation between $500,000 to $1 million) –– and all three Podesta’s have donated to the Clinton Foundation: John ($1k-5k), Tony ($25k-$50k) and Heather ($50k-$100k).

Both Google (between $500,000 to $1 million) and VantagePoint Venture Partners ($25,000 to $50,000) are Clinton Foundation donors –– with Google.org also listed in the $10,000 to $25,000 category, and the BIG search engine did so in 2014.

Moreover, the Goldman Sachs Group Inc. is also a big contributor to the Clinton Foundation: The Goldman Sachs Group, Inc. contributed between $1 million to $5 million, of which some was given in 2014. There’s also between $250,000 to $500,000 that was contributed from the Goldman Sachs Philanthropy Fund.

In order to avoid additional redundancy, here is a bullet point presentation (NOTE: *Clinton Foundation donors):

- Ultra-Rich Top DC Lobbyists, McBee Strategic Consulting (2009 – 2010) and The Podesta Group (2012 to current) / *Heather and Tony Podesta Clinton Foundation donors as documented above

- Highly Influential Special Interest Group, American Council on Renewable Energy (ACORE): SolarCity Member (unknown time)

- More Big Wigs & Obama Pals Invest in or Partner with SolarCity (chronological order by date)

- Al Gore’s firm Generation Investment Management (GIM): Sometime before July 2010, became an investor in SolarCity

- *PG&E Corp: Financial partnership with SolarCity, January 2010 / Clinton Foundation donor as documented under Abengoa

- *Citigroup: Major SolarCity investor, February 2011 / Clinton Foundation donor that will be addressed next

- *Google: Financial partnership with SolarCity, Jun 14, 2011 / Clinton Foundation donor as documented above

- *Bank of America: Became an investor in SolarCity’s “SolarStrong,” November 2011 / Bank of America Foundation is a Clinton Foundation donor, contributing between $500,000 to $1 million … may be more

- *Billionaires George Soros and Nicholas J. Pritzker: Both became a SolarCity investor in February 2012 / Clinton Foundation donor as detailed above

- *Goldman Sachs: Became a SolarCity financial partner in May 2013 / Clinton Foundation donor as detailed above

Apparently, in 2000 the Export-Import Bank “chose Citigroup Inc. as its first private partner in an effort to boost its capacity to provide overseas loan guarantees and risk insurance,” which was reported by the Wall Street Journal.

Fast forward to now: The May 2015 American Transparency report, lists Citigroup Inc. in the “TOP 50 BANKS AS PARTNER TO EX-IM BANK.”

But here’s another Obama bundler buddy named Michael Froman, whom is also an Ex-Im Board Member, ex officio. Froman served in the White House as Assistant to the president and Deputy National Security Advisor for International Economic Affairs, only to be promoted to Ambassador Froman, whom “leads the Office of the United States Trade Representative in its work to open global markets for U.S. goods and services…”

His bio confirms that “prior to joining the Obama Administration, Ambassador Froman served in a number of roles at Citigroup (some say top executive).

As mentioned above, Citigroup is an investor in SolarCity and a significant contributor to the Clinton Foundation: Citigroup Inc. (between $500,000 to $1 million, some of which they did so in 2014) and the Citi Foundation (between $1 million to $5 million) –– yet there could be more.

But that’s not all, because Citigroup is another Big Bank and Big Obama Donor where we find that a slew of its former executives have, or currently hold key positions inside the Obama White House.

The “Too-Big-to-Fail” Citigroup is a Big player inside this green energy scheme, cashing in on many levels, whereas February 2013 research reflected that “Green Citi” was already tied to at least $16 billion in green energy transactions, the majority from President Obama’s 2009-Recovery Act (AKA: the stimulus package).

The American Transparency (AT), Ex-Im Bank Report as well as its Green Energy Sector Micro Report documents many politically-connected companies that not only received Ex-Im Bank financing but also additional subsidies from other federal agencies, but still ended up huge failures.

While this section will expand upon the eleven failed firms that mainly came from the AT report, which received “green energy” Ex-Im Bank financing that exceeds $330 million, I’m confident that with additional time, we would find many more.

And due to the fact that the majority of them are listed inside my January 2014 Obama-backed Green Energy Failure Report, because they received “green” subsidies from other agencies and programs, this section will give insight into the cronyism behind these Ex-Im bank deals.

We’ll start with the electric-car company that was found inside the AT study, called Zero Motorcycles, located in California that scored a $2.84 million Ex-Im deal:

Green motorcycle company is touted as a “success story” on the EX-IM Bank website. The EX-IM Chairman visited the factory and Zero CEO addressed the annual EX-IM Meeting. But, Zero Motorcycles has traded on local, state and federal government purchase rebates, grants, loans and guarantees.

In addition to $2.84 million in EX-IM credit, the California state subsidy for the purchase of a Zero motorcycle is $1,500 and the federal rebate defrays another $1,000 at purchase. Twice, the California Energy Commission awarded Zero grants: $900,000 in 2012 and recently $1 million. The City of Santa Cruz gave Zero $415,000 in perks. In 2015, Zero’s biggest competitor, closed up and exited the electronic motorcycle business.

Summary: Zero Motorcycles is an example of why watchdog organizations decry cronyism. From Governor Schwarzenegger’s (CA) endorsement to millions of dollars in EX-IM credit, Zero’s competitors are having a tough go-of-it fighting government – picking the winners.

- Switzerland-based ABB, Inc.: $89.22 million in 2012 –– ABB laid-off employees at Lake Mary, FL and transferred their work to a new facility in San Luis Potosi, Mexico

- Calisolar/ Silicor Materials, California: $4.5 million in 2011 –– Calisolar, in 2011 and 2012, fired 80 workers, laid off employs and, along the way, changed their name

- SolFocus, California: $10 million in 2011 and 2012 –– In September 2013, SolFocus closed their doors.

- Willard & Kelsey Solar Group, LLC, Ohio – $5.85 million between 2011 and 2012 –– They officially shut down on June 30, 2013 –– though it had largely stopped production in April 2013

Amonix, Nevada: $9 million in 2011 –– Bankrupt on July 18, 2012

According to the AT Green Energy Sector report:

Again, EX-IM backed a now defunct solar company with millions of dollars in “working capital” payments. In March 2011, EX-IM provided this support by guaranteeing the transfer through Silicon Valley Bank. By July 2012, Amonix had closed up shop owing $100 million in debt. In addition to EX-IM support, the company was also the reported recipient of $20 million in federal tax credits and grants.

The Green Corruption Files (GCF) January 2014 Obama-backed Green Energy Failure Report noted that the Amonix solar manufacturing plant in North Las Vegas was subsidized by millions in federal tax credits and grants, which began under the Bush administration when they snagged a total of $15.6 million in grants.

The Green Corruption Files (GCF) January 2014 Obama-backed Green Energy Failure Report noted that the Amonix solar manufacturing plant in North Las Vegas was subsidized by millions in federal tax credits and grants, which began under the Bush administration when they snagged a total of $15.6 million in grants.

Under President Obama, Amonix, in January 2010, were winners of two of the stimulus-enacted Section 48C Tax Credits at the tune of $9.5 million. In September 2011, Amonix was awarded $4.5 million for a project in California –– from the DOE’s Office of Energy Efficiency and Renewable Energy (EERE) under the SunShot Initiative, of which we know that the EERE received $16.8 billion from the 2009-Recovery Act for programs and initiatives.

Additionally, in September 2011, a $90.6 million DOE stimulus loan went to Cogentrix Energy for a solar generation project in Alamosa, Colorado, not only to create a whopping 10 jobs, but also to buy solar panels from Amonix.

Cogentrix of Alamosa, LLC (Cogentrix Energy), by the way, is a subsidiary of Goldman Sachs.

This was a striking detail that I found when reviewing the June 19, 2012 House Oversight Hearing, where the CEO of Cogentrix Mr. Robert Mancini testified. It was one transaction where Goldman Sachs cashes in every step of the way –– and their green cronies too (documented here). See graph left from the Office of the House Oversight and Government Reform Office.

MiaSolé (Hanergy of China), California: $62.7 million, starting as early as 2010 –– Sold to China’s Hanergy Holding Group for $30 million

Once with a market value of $1.2 billion, MiaSolé received $101.8 million federal tax credits and EX-IM support included $9.0 million in “working capital” funding. Venture capital of up to $500 million had been raised for the original MiaSole thin solar panel business. Despite the government largess, MiaSole needed a “white knight to rescue it from oblivion,” and the solar company sold for a fire-sale price of $30 million to the Chinese solar giant Hanergy (2012). Total EX-IM support of MiaSole is $62.97 million – with the majority of it coming after the sale to Hanergy – despite the fact that Hanergy is a massive Chinese energy company. Is EX-IM doing proper due diligence? Analysts have questioned its accounting practices.

In fact, the Washington Free Beacon points out that “Hanergy’s acquisition of MiaSolé brings it into direct competition with American thin film solar panel manufacturers such as First Solar and SoloPower.”

Cronyism: These two companies are great examples of how crony capitalism works, especially inside this massive green energy scheme. First, prior to the sale of the company MiaSolé to the Chinese, investors included Kleiner Perkins, VantagePoint Venture Partners, and others. Meanwhile, Goldman Sachs had an invested interest in Amonix, while the company’s investors were Kleiner Perkins as well as the Westly Group — all FOUR of these big Obama-Clinton cronies as presented in this Green Corruption File.

But there’s more…

Abound Solar, Colorado: $18.17 million (For example in July 2011, a $9.2 million loan to Punj Lloyd Ltd to purchase panels from Abound): –– In June 2012 Abound went down

Abound Solar not only received support of over $18 million in EX-IM export support to India, but also received $400 million in loan guarantees from the Department of Energy (DOE). The EX-IM support was provided in a series of transactions as late as August 2011. But, by June 2012, Abound filed for bankruptcy. Shutting its doors left 405 unemployed and between a $40- $60 million tab for taxpayers. Abound simply abandoned its production facilities, leaving a mess of 100,000 solar panels and 4,100 gallons of toxic waste. Estimates of potential cleanup costs were forecasted in the range of $3.7 million.

NOTE: also documented was $1 million in property tax rebates (CO), $12.1 million Indiana Development Corporation

In the meantime, the GCF’s January 2014 Obama-backed Green Energy Failure Report shared some other details about Abound, which was formerly known as AVA Solar, that had won part of a $60 million grant under the Bush administration ($27 million in DOE funding for the Photovoltaic Module Incubator projects), as well as $3 million from the SunShot Initiative.

Cronyism: Abound Solar is tied to Democratic politicians at the federal level and the state level in Colorado. Billionaire heiress Pat Stryker, a major Democratic campaign bundler, was a key investor in Abound Solar. She was also a 2008 Obama bundler; a donor to his 2009 inauguration as well as the 2012 Obama Victory Fund. In the mix, Invus Public Equities Advisors LLC, tied to Republicans, also backed Abound Solar.

Evergreen Solar, Massachusetts: $31.8 million, during the period 2009-2010 –– Bankrupt on August 2011

Again, we will begin with the findings of the AT Green Energy Sector report:

Eventually, Evergreen Solar filed for Chapter 11 bankruptcy after disclosing that they were hundreds of millions of dollars in debt without the requisite profit margins to support the liability. Evergreen received $50 million from the State of Massachusetts and $31.8 million of export support from EX-IM.

The company was the fan favorite of the Massachusetts political class. During the period 2006 to 2010, Evergreen piled up a collective deficit of over $1.003 billion. The company lost money every year: $26.7M (2006), $16.5M (2007), $228.6M (2008), $266.2M (2009), and $465.4M (2010). EX-IM support was approved during the period 2009-2010 – after its stock price had tumbled 90%. The Wall Street Journal dubbed the company, Nevergreen Solar.

During Chapter 11 proceedings, Evergreen’s plan was to shed debt, reorganize and move manufacturing to China! Isn’t the mission of EX-IM to support jobs in U.S.A.?

Moreover, on October 28, 2009, Evergreen Solar Inc. won the “Export Achievement Certificate.”

And again, the GCF’s January 2014 Obama-backed Green Energy Failure Report gives some more interesting tidbits about Evergreen, starting with the fact that was one of President Obama’s pet projects that received stimulus funds, grants, tax credits, low-interest loans and subsidies, yet the transactions are difficult to track.

In April 2009, the White House announced Evergreen as a “green jobs creator,” claiming that the Recovery Act was working. It had been reported many times that Evergreen was a beneficiary of federal “stimulus funds,” as dug up by the Washington Times. The problem with tracking the Evergreen subsidies is that, at the time their bankruptcy was publicized in August of 2011, the data went missing from federal records.

Evergreen was also awarded two $650,000 grants from the Department of Commerce: National Institute of Standards and Technology. And, now we see that they scored $31.8 million of Ex-Im support.

With all that taxpayer cash, Evergreen went bankrupt in August 2011. Adding to the insult were reports of 800 USA job losses, while moving their “green jobs” and entire company to China –– another case of green energy outsourcing.

Cronyism: Evergreen Solar, Beacon Power as well as Vehicle Production Group –– three green stimulus sweetheart deals that went bust –– at the time of their subsidies, were part of the Perseus Energy & Technologies Portfolio.

And guess who served as the Vice Chairman of Perseus, LLC at that time?

Yep, another Obama bundler. But not just any: It was the infamous Washington fixture (does Fannie Mae ring a bell?), James A. Johnson, whom for a very short time, headed Obama’s vice presidential selection committee in 2008 –– and that I wrote about in 2012.

Solyndra, CA: $10.3 million in 2011 –– Bankrupt: September 2011

Department of Energy loan guarantees of $535 million and loan recapitalizations just weren’t enough. In February 2011, EX-IM approved $10.3 million in long-term credit to Solyndra’s exports to Belgium. By August 2011, Solyndra’s demise left 1,100 people unemployed and unpaid debts of almost $600 million.

The GCF’s January 2014 Obama-backed Green Energy Failure Report noted that it was in September 2009 when Solyndra received that $535 million 1705 DOE stimulus loan despite its “junk rating,” as well as $25.1 million in California tax credit. In 2011, Solyndra bagged another loan, but this time from the Export-Import Bank, which was obtained by a third-party company to the tune of $10.3 million. According to The Center for Public Integrity, “That money financed a project that put Solyndra solar panels on the roof of the Delhaize supermarket chain’s distribution center, outside of Brussels.”

And, like Abound Solar, Solyndra “required a big hazardous waste cleanup after it went bankrupt and abandoned its property.” Solyndra, once the poster child for the president’s clean-energy success, back then, took its place in history: an art exhibit at the UC Botanical Garden at Berkeley, at the price tag of half a billion taxpayer dollars.

Taxpayer money lost: The DOE loan drawn was $528 million, recovered is $0. Furthermore, there was an October 2012 analysis by the Institute for Energy Research regarding the Solyndra damage that predicted that the loss [to taxpayers] could be as high as $849 million. In the meantime, the November 2012 analysis by the Heritage Foundation placed the Solyndra bad bet at $570 million.

Cronyism: Solyndra is tied to 2008 Obama bundler billionaire George Kaiser as well as Steve Spinner, a two-time Obama bundler and DOE insider, Goldman Sachs and others. And, while Goldman Sachs has been noted here as big Clinton Foundation donor, it’s interesting that George B. Kaiser is as well, contributing between $100,000 to $250,000, some of which he did so on 2014

SolarWorld: Ex-Im Bank transactions exceed $86 million in green deals –– Having financial issues

- In April 2009 the Ex-Im Bank approved at total of just over $61 million in loans for SOLARWORLD INDUSTRIES AMERICA LP “to sell solar panels in South Korea.”

- On September 30, 2011, “the Ex-Im Bank board of directors approved an $18.9 million direct loan to Tatith Energies of Gujarat, India.” Apparently, the loan was in order to “support the purchase of construction services from American Capital Energy and solar panels from SolarWorld California.”

- In September 2012 “the Ex-Im Bank provided a $6.4 million loan guarantee to finance the export of solar modules from West Coast-based SolarWorld Americas to Williams Industries Inc.-Williams evergreen Ltd. of St. Thomas, Barbados.”

It should be noted that in March 2013 the Free Beacon reported that, “The Ex-Im also approved financing for companies seeking to purchase solar panels from SolarWorld, another struggling solar panel manufacturer. The companies ultimately rejected the Ex-Im financing, a move described by a bank spokesman as rare.”

So, its unclear if ultimately SolarWorld benefited from the Bank, but they did get plenty of other “green” federal and state subsidies, which is outlined inside the GCF’s January 2014 Obama-backed Green Energy Failure Report.

The German-owned company SolarWorld “is a solar pioneer, one of the world’s largest solar-technology producers and the largest U.S. solar panel manufacturer for 40 years.”

Hillsboro, Oregon is the site of their Americas headquarters (Solar World Industries America). In January 2010, SolarWorld was allotted an $82.2 million Advanced Energy Manufacturing Tax Credit, which as mentioned, was enacted by the 2009-Recovery, as section 48C. Then, in September 2011, SolarWorld was awarded $4.6 million for a project in Hillsboro, Oregon. This was funded through DOE’s Office of Energy Efficiency and Renewable Energy (EERE) under the SunShot Initiative (again, the EERE received $16.8 billion from the 2009-Recovery Act for programs and initiatives).

The Heartland Institute noted that at some point, “[Ohio] state officials invited the company [SolarWorld] to apply for up to $100 million in [taxpayer] subsidies and the company accepted at least $27 million in subsidies.”

Cronyism: While there is more to the SolarWorld story, for some (the Weekly Standard) it demonstrates “Some Compelling Evidence that ‘Green Energy’ is All About Crony Capitalism.”

In closing…

Absolutely, green energy –– whether it’s renewable, alternative or clean –– is a large, expensive and deceptive scheme. And like all the other government agencies doling out the “green cash,” the Export-Import Bank of the United States may be a small agency, but it’s another mechanism that feeds the massive “crony capitalism” beast ravaging Capital Hill.

Congress should let the Bank shut down.

About the author

Christine Lakatos is an ACE Certified Fitness Trainer (1995) and consultant with experience in the health and fitness industry since 1980. She even authored a diet book in 2008.

Lakatos, who was a track-star in her younger years, picked up sports again in her late 20’s. She is a retired bodybuilder and fitness competitor, whom competed from 1989 to 1995, winning titles such as Ms. San Luis Obispo 1989, Ms. Fitness San Diego 1993, Ms. Fitness USA Top Ten (1990), and many more. She was also an American Gladiator contestant in 1990.

She’s a mother of two awesome daughters and a proud Christian. She loves learning and has been known to study the bible frequently. She’s also an animal lover –– so it’s no wonder that she has three dogs.

In 2009, as a strong conservative and concerned citizen, Lakatos began activism in politics by first becoming a writer for Blogcritics Magazine, covering an array of issues from the Tea Party rise, to ObamaCare, homeland security, earmark reform, as well as hot topics of the day.

By 2010, she began unleashing her green energy research and its subsequent cronyism and corruption that eventually lead to the formation of The Green Corruption Files in April 2012.

by

by